Trump's Digital Tulip Bulbs

His crypto evangelism could help precipitate the next financial crisis.

This article originally appeared in Canada’s Globe and Mail on March 19, 2025.

At this month’s White House “digital assets summit,” U.S. President Donald Trump vowed “to make America the bitcoin superpower of the world and the crypto capital of the planet.”

That’s a bit like making the U.S. a world leader in blackjack, but Mr. Trump has already taken significant steps in that direction — halting Joe Biden’s aggressive crackdown on the industry, appointing crypto supporters to key administration positions and signing an executive order creating a national crypto reserve, which even The Wall Street Journal regards as “fool’s gold” and an invitation to government mischief.

All of this should worry you. Here’s why.

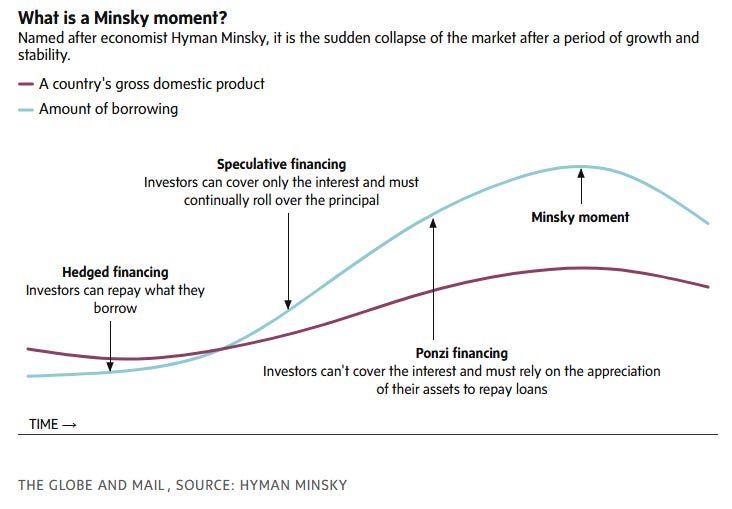

You may never have heard of Hyman Minsky, but his influence as an economist surged after the 2008-09 financial crisis. That’s because of his Financial Instability Hypothesis, which holds that in the absence of prudential regulation, financial crises are not just anomalies but inevitabilities.

Prof. Minsky argued that financial markets tend naturally toward instability, as the relentless pressure of competition forces investors into a vicious cycle of ever-riskier trades fuelled by ever-increasing leverage generating ever-growing systemic risk. That leads inevitably to a “Minsky moment,” the point when the market realizes the game is up and everyone rushes for the exits.

The housing bubble and subsequent crisis seemed to many to confirm Prof. Minsky’s thesis. It had followed a trajectory common in the annals of booms and busts: An irrational herd chases asset prices to unsustainable levels, fuelled by FOMO and imprudent borrowing. Eventually, general risk aversion sets in, teeing up a panic. All that’s needed is a shock — rumours of a major default, a surprise hike in interest rates, a political crisis — to spook the market herd and cue the Minsky moment. Then comes the collapse in prices, the liquidity crisis and recession — U-shaped or V-shaped, depending — topped off by a taxpayer-funded bailout of the people who burned the house down.